A Home Equity Conversion Mortgage (HECM) Loan vs. a Cash-Out Refinance: What Are the Advantages?

A common goal for homeowners seeking to refinance their mortgage is a lower interest rate. A lower rate could mean a reduced monthly mortgage payment or significant savings on interest paid over the life of the loan.

Over the past year and a half, the Federal Reserve has been trying to tamp down inflation by increasing interest rates. With the average 30-year mortgage nearing 8%, most homeowners today wouldn’t achieve an interest-rate-reduction benefit from refinancing their existing mortgage.

There are times, however, when refinancing to a higher interest rate can be a wise move.

Homeowners might be willing to refinance to a higher interest rate when looking to:

- Convert built-up home equity into usable cash

- Adjust the terms of the loan (e.g., switch from adjustable-rate to fixed-rate mortgage)

- Eliminate monthly mortgage payments via a Home Equity Conversion Mortgage (HECM) loan (Borrower must still pay critical property charges, like homeowners insurance and property taxes)

For most homeowners 62 and older, home equity represents the greatest portion of their net wealth. While home equity is a good thing, it’s of little functional value to homeowners unless they sell the home or tap the equity.

Two common home refinance options that double as home-equity-release loans are a traditional cash-out refinance and a HECM, commonly called a reverse mortgage loan.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new, larger mortgage that includes a new interest rate, a new required monthly principal and interest mortgage payment and new loan terms. It differs from a standard mortgage refinance in that you convert a portion of your home equity into a lump sum of cash paid to you at closing.

What Is a HECM Loan?

A HECM is a home-secured loan that enables older-adult homeowners to convert a percentage of their home equity into usable cash. Some or all of the loan proceeds can be used at closing to refinance (pay off) an existing mortgage.

The borrower can defer repayment of the loan balance until a much later date, typically until the last surviving borrower moves out or passes away. As with any mortgage, the borrower must continue paying critical property charges, like property taxes and homeowners insurance.

While there are several reverse mortgage loan types, HECMs are the most popular option and the only one insured by the Federal Housing Administration (FHA). This article refers only to HECMs.

Curious what you may qualify for? Use our HECM reverse mortgage calculator!

Advantages of a HECM Over a Cash-Out Refinance

Flexible Repayment Feature

With a HECM, the borrower can repay as much or as little toward the loan balance each month as they want or choose to make no monthly mortgage payment. In other words, the interest rate has no bearing on how much a borrower is required to pay each month because they can pay as little as $0 a month. This repayment flexibility can be a real game changer for a retiree’s cash flow strategy.

Again, as with any mortgage, the borrower must pay property-related charges, like homeowners insurance and property taxes. While the interest rate doesn’t affect what the borrower will be required to pay each month, interest and fees get tacked onto the loan balance, so deferring repayment each month will raise the loan balance over time.

Generally, the HECM loan balance doesn’t become due and payable until the last remaining borrower moves out or passes away, and then, in most cases, the home is sold to repay the loan.

With a cash-out refinance, the borrower must pay monthly principal and interest mortgage payments, per the loan terms. This monthly repayment obligation can reduce a senior borrower’s cash flow throughout retirement. Also, swapping a lower interest for a higher one can increase a borrower’s cash outlay over the life of the loan.

On the positive side, like any forward mortgage, steady monthly payments over time will reduce and eventually fully repay the loan balance.

Easier Qualification for 62+ Homeowners (Typically)

With a HECM, there are specific qualifications and requirements for a reverse mortgage that the prospective borrower must meet to qualify for the loan. While there is no minimum credit score requirement, the lender will conduct a financial assessment of the applicant’s credit history, property charge history and monthly residual income when deciding whether to approve the loan. The lender will seek to determine if the borrower can pay the ongoing property charges, such as insurance, taxes and HOA dues.

With a cash-out refinance, a credit score of 620 or greater is generally required for the prospective borrower to qualify. The lender will seek to determine if the borrower has the means to repay the loan balance on a monthly basis and pay other property-related charges for the duration of the loan. Since there are required principal and interest mortgage payments, a cash-out refinance generally will have more stringent income requirements.

Unlike the HECM, which requires borrowers to be 62 or over, a borrower can do a cash-out refinance at any age.

Offers More Payout Options

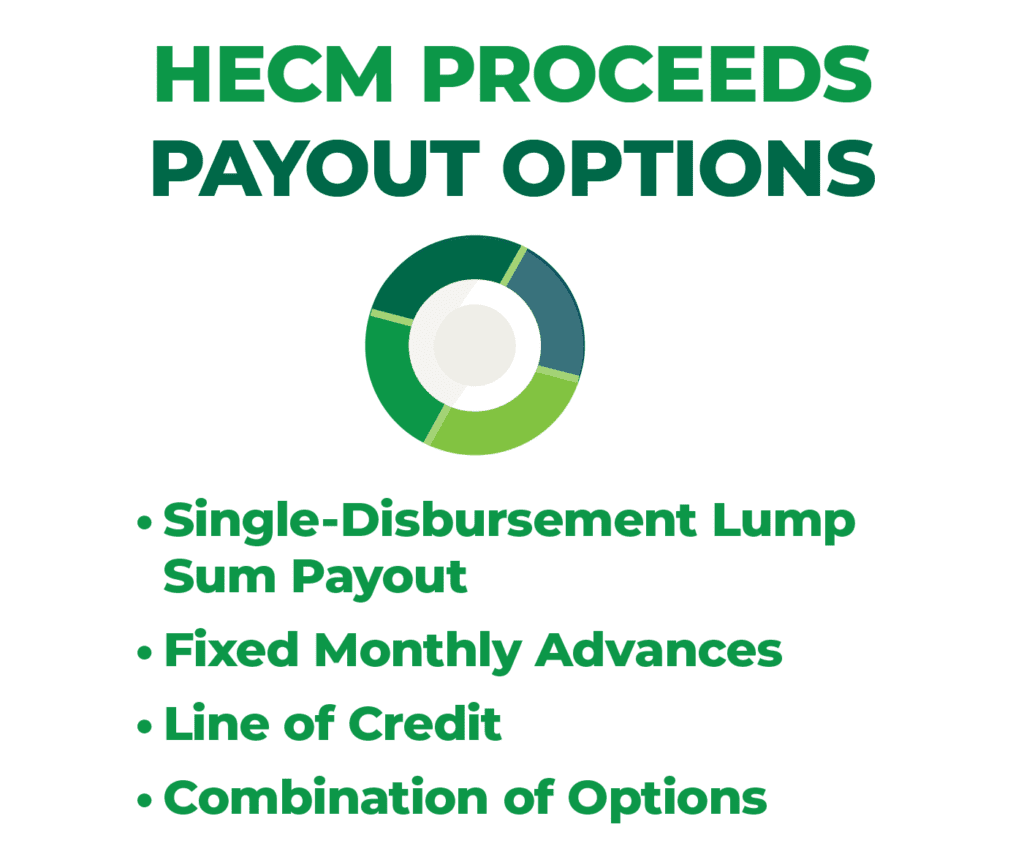

With a HECM, the borrower can choose to receive their loan proceeds in several ways:

- A single-disbursement lump sum payout

- Fixed monthly advances (for a set number of months or over the life of the loan)

- A line of credit

- A combination of these options

With a cash-out refinance, the only option is a lump sum payout at closing.

Line of Credit Growth Potential

With a HECM line of credit, the unused portion of the credit line grows at the same compounding interest rate as the loan balance (independent of swings in the home’s value), giving the borrower access to even more funds over time. It’s also secure, as the HECM line of credit cannot be canceled, reduced or eliminated due to market conditions.

From a financial planning standpoint, it can be valuable to establish the HECM line of credit sooner rather than later.*

With a cash-out refinance, expanded borrowing capacity down the road and the ability to borrow from a line of credit as needed are not options.

Non-Recourse Feature

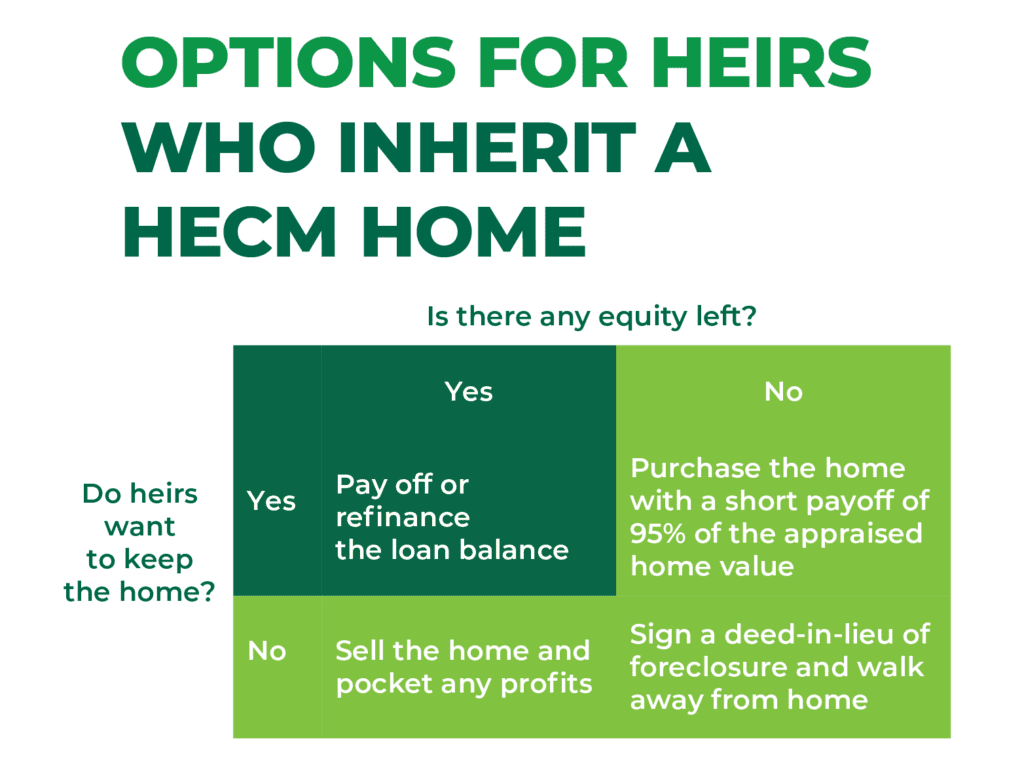

It can be great peace of mind for HECM borrowers to know that neither they nor their heirs will ever owe more on the loan than the value of their home. Even if the HECM borrower defers the loan balance for a very long while, and the property value is worth less than the loan balance, the home sale will always satisfy the loan. Thanks to the loan’s FHA-insured non-recourse feature, the home stands for the debt, not the borrower or the heirs.**

After the borrower passes, here are options for the heirs:

- Sell the home and pocket any profit

- Sign a deed-in-lieu of foreclosure and walk away from the home (when they don’t want the home and there is no financial benefit from selling the home)

- Pay off the mortgage balance and keep the home

- Obtain a short payoff of 95% of the current home value (when they want to keep the home and the loan balance exceeds the home value)

A cash-out refinance is generally not considered a non-recourse loan and offers borrowers and their heirs no such protections.

Is Refinancing Into a HECM Loan Right for You?

A HECM can be an excellent choice for older-adult homeowners carrying a traditional mortgage who have significant home equity and desire to free up cash in retirement.

However, like any mortgage, a HECM has pros and cons. Everyone’s situation is different and the best mortgage refinance option for you is the one that best aligns with your particular situation and goals. At Fairway, we’re committed to helping you understand all options so you can make an educated decision regarding your home. Connect with us today!

*This advertisment does not constitue financial advice. Please consult a tax and/or financial advisor regarding your specific situation.

**There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

Copyright©2023 Fairway Independent Mortgage Corporation (“Fairway”) NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency. Reverse mortgage borrowers are required to obtain an eligibility certificate by receiving counseling sessions with a HUD-approved agency. The youngest borrower must be at least 62 years old. Monthly reverse mortgage advances may affect eligibility for some other programs. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity.