Tapping Housing Wealth To Help Fund Long-Term Care

If you’re in or nearing retirement, you may be worried about risks that can drain your savings faster than you ever projected and compromise your monthly cash flow and desired retirement lifestyle.

Spending surprises (e.g., unforeseen need to help family members, divorce, rising health care costs, changes in public health coverage that restrict eligibility, home repairs and long-term care needs) can throw a wrench into a retiree’s cash flow strategy. And inflation—now a top concern for many seniors—can erode the purchasing power of savings over time.

The article explores:

- The challenging future of long-term care for older adults

- Why senior homeowners may want to consider a reverse mortgage loan to help pay for the care they need and want

- The “Unwinding of Medicaid Continuous Coverage: What Does It Mean for You?”—a recent article from the National Council on Aging (NCOA) regarding the millions of Americans that may lose their Medicaid benefits or experience a coverage gap due to the ending of the federal public health emergency for COVID-19

Long-Term Care Challenges

Long-term care involves various services designed to help people meet their health and personal care needs when they can no longer do it themselves, either for a short or long period.

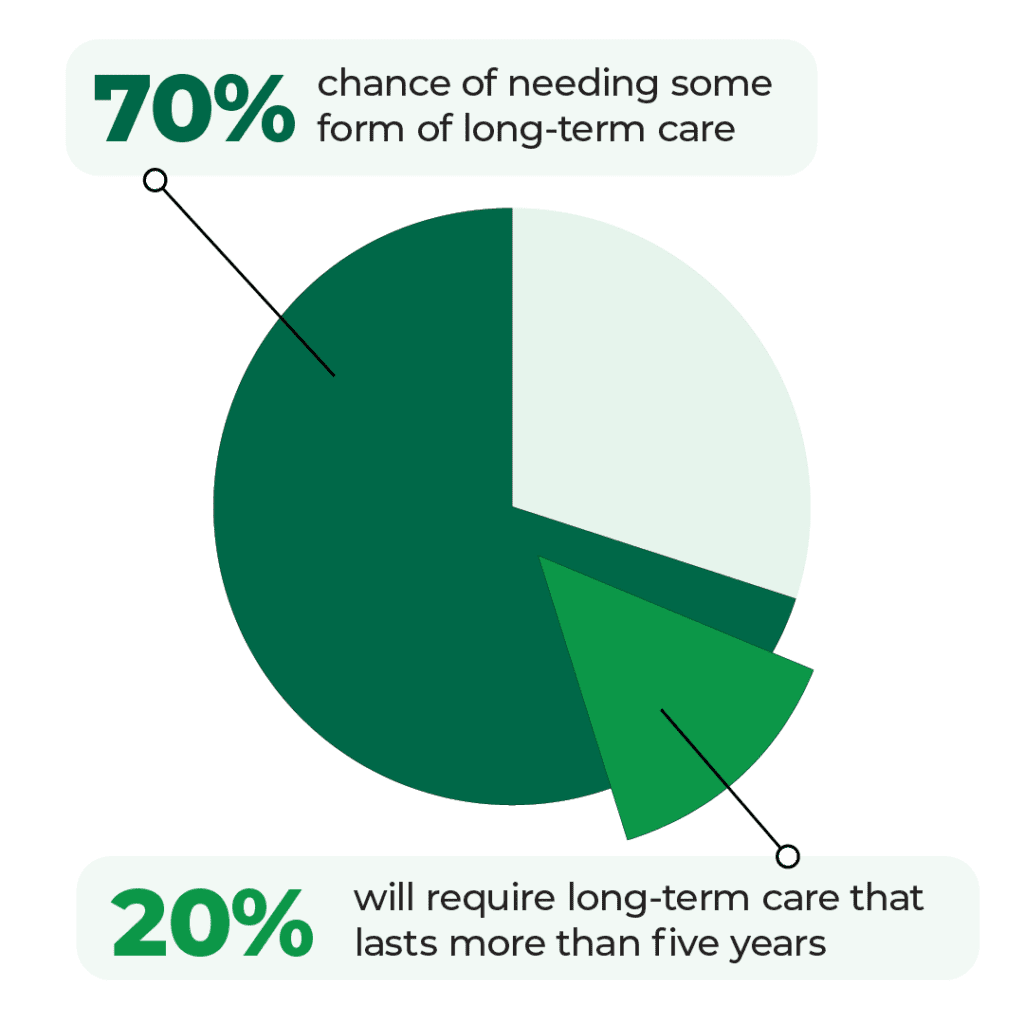

The hard truth is that most people will need long-term care at some point. According to the U.S. Department of Health and Human Services (HHS), a 65-year-old has nearly a 70% chance of needing some form of long-term care, while 20% will require long-term care that lasts more than five years. The median annual cost (nationwide) for a home health aide is $61,776, and, on average, it costs $54,000 a year for a senior to reside in an Assisted Living Facility.

Some families choose to provide the care themselves (e.g., adult children take turns caring for their mom at her home). Still, that approach has opportunity costs, such as family members sacrificing a large amount of their free time.

Medicare generally doesn’t cover long-term care services, and only a small percentage of older Americans have private long-term care insurance (LTCI). While LTCI can prove invaluable, the high cost of premiums makes it unaffordable for many seniors. Those who can afford LTCI premiums still have to pass underwriting guidelines to be covered.

More often than not, payment for care is paid out-of-pocket or financed by the recipients of the care or by their families (estimated at 53%). Alternatively, much of the rest of the spending is usually paid through Medicaid coverage, according to the HHS.

Financing Long-Term Care With Housing Wealth

Homeowners aged 62 and over in the U.S. have experienced impressive growth in home equity (now estimated at over $11 trillion). In fact, for most senior homeowners, the home is their single largest source of savings. So, when exploring viable options for funding long-term care, it’s wise not to overlook or dismiss the home—it’s often where the lion’s share of a senior homeowner’s wealth can be found.

While home equity is good, it's of little functional value unless the home is sold or the equity is tapped. Most older homeowners prefer not to sell and move to finance long-term care and would rather age in the home they know and love for as long as possible.

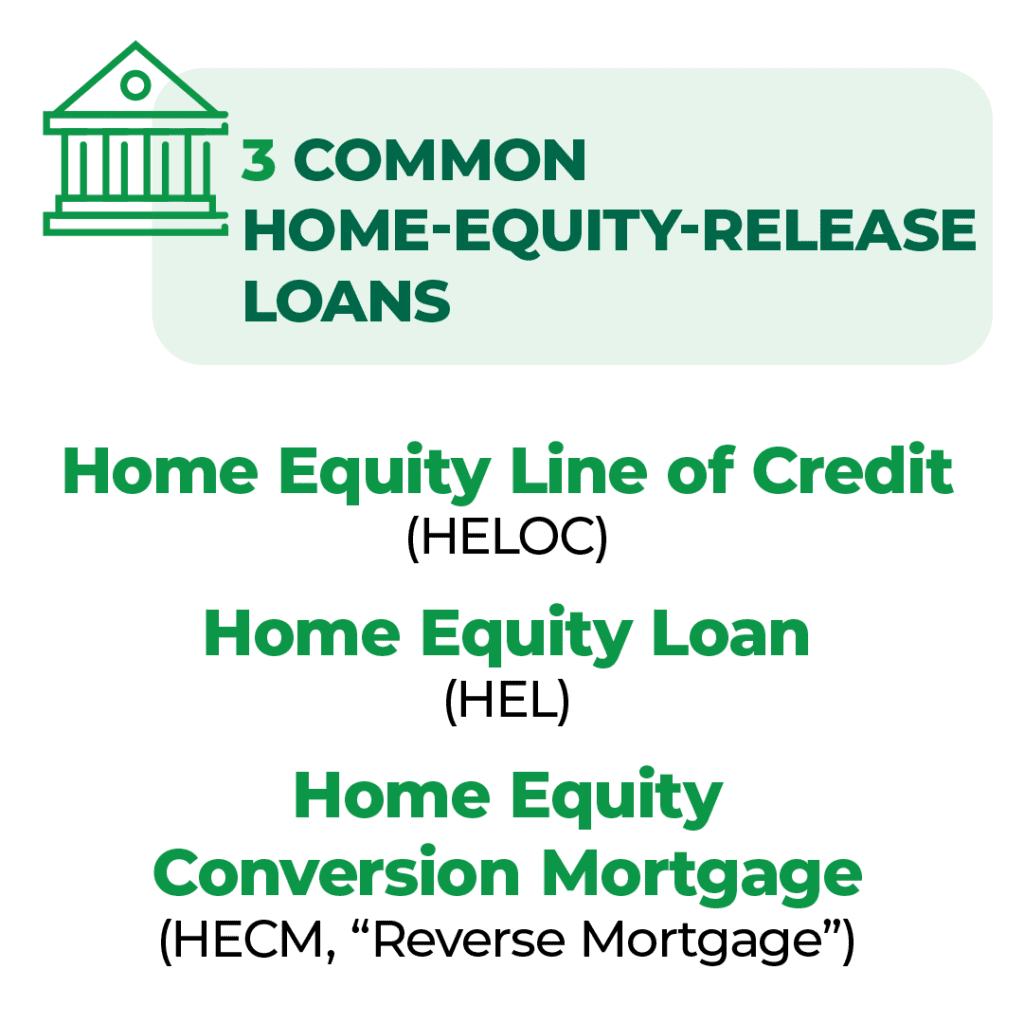

Access to a portion of the built-up home equity (while still living in the home) can be achieved via a home-equity-release loan. Three common ones available today for senior homeowners are the Home Equity Line of Credit (HELOC), Home Equity Loan (HEL) and the Home Equity Conversion Mortgage (or HECM, also called a reverse mortgage) loan. Though each of these financial instruments uses the home as collateral and allows the borrower to use the funds for any purpose, they work in different ways and have different implications.

Of the aforementioned loan types, a HECM loan is the only one specifically designed for homeowners aged 62 and older and their unique needs. Check out our home equity loan comparison article for an in-depth look at the three loan types.

What Is a HECM and How Does It Work?

A HECM (Home Equity Conversion Mortgage) is the only reverse mortgage insured by the Federal Housing Administration (FHA) and is the most popular reverse mortgage among homeowners.

It allows homeowners 62 and older to access a percentage of their home equity as:

- A single-disbursement, lump sum payout of cash at closing

- Fixed monthly advances for a set number of months or the life of the loan

- A line of credit

Unlike other home-equity release loans, with a HECM, the borrower can pay as much or as little toward the loan balance each month as they wish. Or the HECM borrower can opt to make no monthly mortgage payments at all (though they must live in the home, maintain it and pay property charges, like taxes and insurance).

The unpaid loan balance accrues interest and fees and eventually must be repaid. However, a HECM balance does not typically become due and payable until the last surviving borrower permanently leaves the home (e.g., passes away or moves into a nursing home), regardless of how far into the future that may be. The loan balance can also become due and payable if the borrower neglects their loan obligations, such as failing to pay the property taxes in a timely manner.

When the loan is due and payable, it’s typically satisfied via the home sale. Neither the borrower nor the heirs will ever owe more than the value of the home when it’s sold to repay the loan. It’s what’s known as the loan’s non-recourse feature, and the FHA insures it.*

For a more in-depth look at the features of HECM reverse mortgages, check out our breakdown of how a HECM works.

Financing Long-Term Care With a HECM**

Here are just a few ways HECM loan proceeds can help a borrower fund long-term care:

- Pay for long-term care insurance premiums (before needing care)

- Fund the deposit on a nursing home (e.g., the care is needed for one spouse and the other spouse still lives at home)

- Self-fund professional or informal care for a period of time (e.g., pay for an in-home care nurse while recovering from a fall)

These days, the most popular way HECM borrowers choose to receive their loan proceeds is via a line of credit. For long-term care planning, it can be valuable to establish the HECM line of credit sooner rather than later—well before long-term care is needed. That’s because the unused portion of the available credit doesn’t accrue interest or fees, and the available line grows at the same compounding rate as the loan balance (independent of swings in the home’s value), giving the borrower access to even more funds over time.**

It’s feasible that the available funds in a HECM line of credit established at age 62 and left unused to grow until it’s needed for long-term care at age 82 could be greater at that time than the home value.**

It’s also great peace of mind to know that the available HECM line of credit will be there when care is needed, as it cannot be frozen, reduced or canceled due to the market conditions.

The Unwinding of Medicaid Continuous (Protective Medicaid) Coverage

In 2020, at the height of the pandemic, Congress passed the Families First Coronavirus Response Act, which prevented states from terminating Medicaid until after the public health emergency was declared over.

As of February 2023, states were allowed to resume the redetermination process (re-evaluating everyone on Protected Medicaid and either confirming their eligibility or transitioning them off Medicaid).

Based on a recent Kaiser Family Foundation survey, up to 17 million Americans can lose Medicaid coverage—including some people who are no longer eligible and others who are still eligible but face administrative barriers to renewal.

Do either of these situations pertain to you, loved ones or someone you know?

- I have Medicaid. How can I prepare for Medicaid Continuous Coverage changes?

- I found out I’m being dropped from Medicaid. What now?

If so, we encourage you to read the recent article “Unwinding of Medicaid Continuous Coverage: What Does It Mean for You?” from the National Council on Aging (NCOA). It lays out the steps you can take to reduce your risks of losing Medicare benefits and affordable alternatives if you or your loved ones lose coverage.

In Summary

Retirees face no shortage of risks that can quickly drain or wipe out their retirement savings. When it comes to your health in your retirement years, ensuring adequate health coverage now and a plan for funding long-term care if/when needed is critical. Housing wealth is poised to play a key role for seniors looking to self-fund or insure their future health and personal care needs.

If you want to learn more about HECM reverse mortgages and if one might be right for you or a loved one, our Fairway reverse mortgage planners are here to help.

*There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

**This article does not constitute financial advice. Please consult a financial advisor regarding your specific situation.

Copyright©2023 Fairway Independent Mortgage Corporation (“Fairway”) NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency. Reverse mortgage borrowers are required to obtain an eligibility certificate by receiving counseling sessions with a HUD-approved agency. The youngest borrower must be at least 62 years old. Monthly reverse mortgage advances may affect eligibility for some other programs. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity.