Integrating Home Equity Conversion Mortgage (HECM) Loans in Estate Planning

If you’re an attorney working in estate planning, knowing all available financial tools is critical for your clients and your practice. With the continued strength of home values in the United States, coupled with inflation and potential market volatility, Home Equity Conversion Mortgage (HECM) loans, also called reverse mortgage loans, can be a particularly helpful option in your toolkit.

This Article Covers:

- Decoding HECMs

- The Real Estate Landscape, Inflation and HECMs

- Why HECMs Are Essential for Estate Planning

- Final Thoughts: Crafting a Focused Estate Blueprint With HECMs

Decoding HECMs

What Are They?

The Home Equity Conversion Mortgage (HECM) is the most popular type of reverse mortgage loan and the only one insured through the Federal Housing Administration (FHA). HECMs allow homeowners 62 and older to convert a portion of their home equity into usable cash.

Homebuyers 62 and older can also use a HECM to purchase a new home in lieu of a traditional mortgage to finance part of the home’s cost.

How Do They Work?

The proceeds from the HECM first go towards any remaining mortgage balance. From there, the borrower can receive the remaining proceeds as a lump sum, tenure payment, term payment, a line of credit where the unused portion grows over time or a combination. For borrowers who own their homes outright, the potential proceeds are simply that much greater.

The borrower can choose to pay as much or as little toward the HECM loan balance each month as they’d like — or they can decide to make no monthly mortgage payments at all — for so long as they occupy the home as their primary residence and pay the property-related taxes, insurance and upkeep expenses. For more information, check out our in-depth breakdown.

How and When Are They Generally Repaid?

The HECM loan becomes due and payable when one of the following maturity events occurs:

- Borrower(s) sells the home or transfers the title

- Borrower(s) no longer lives in the home as the primary residence (12 consecutive months for mental or physical illness)

- The property is in disrepair and the borrower(s) refuses or is unable to repair the property

- Borrower(s) fails to pay property charges and all attempts to rectify the situation have been exhausted

- The last surviving person on the loan passes away. (An eligible non-borrowing spouse who still occupies the home may be able to stay in the home and defer the due and payable status of the loan. The non-borrowing spouse must keep up with the responsibilities of the loan, such as paying the property charges, like taxes and insurance)

The debt due is the total amount borrowed, plus interest and fees, that the borrower hasn’t voluntarily paid down over the life of the loan. Interest and mortgage insurance premiums (MIPs) will continue to be tacked onto the outstanding loan balance until the loan is paid and settled.

Repayment of the loan by the borrower or heirs is typically accomplished via the sale of the property. However, the borrower or heirs may pay off the debt with another qualifying source of funds, such as funds from a savings account or a refinance of the loan balance.

The borrower or heirs can benefit from the HECM’s non-recourse feature in cases where the loan balance is higher than the home value. Non-recourse means that the HECM borrower (or their estate) will never owe more than the loan balance** or the property’s value (whichever is less), and no assets other than the home have to be used to repay the debt. If the home value is higher than the loan balance due, the borrower (or the heirs) can keep the remaining proceeds when the home is sold and the loan is paid off.

The FHA guarantees the non-recourse feature. The required MIPs collected on HECM loans end up in the Mutual Mortgage Insurance (MMI) Fund, which the FHA uses to pay out claims when the home sells for less than the loan balance.

How Do They Work for Heirs of an Estate?

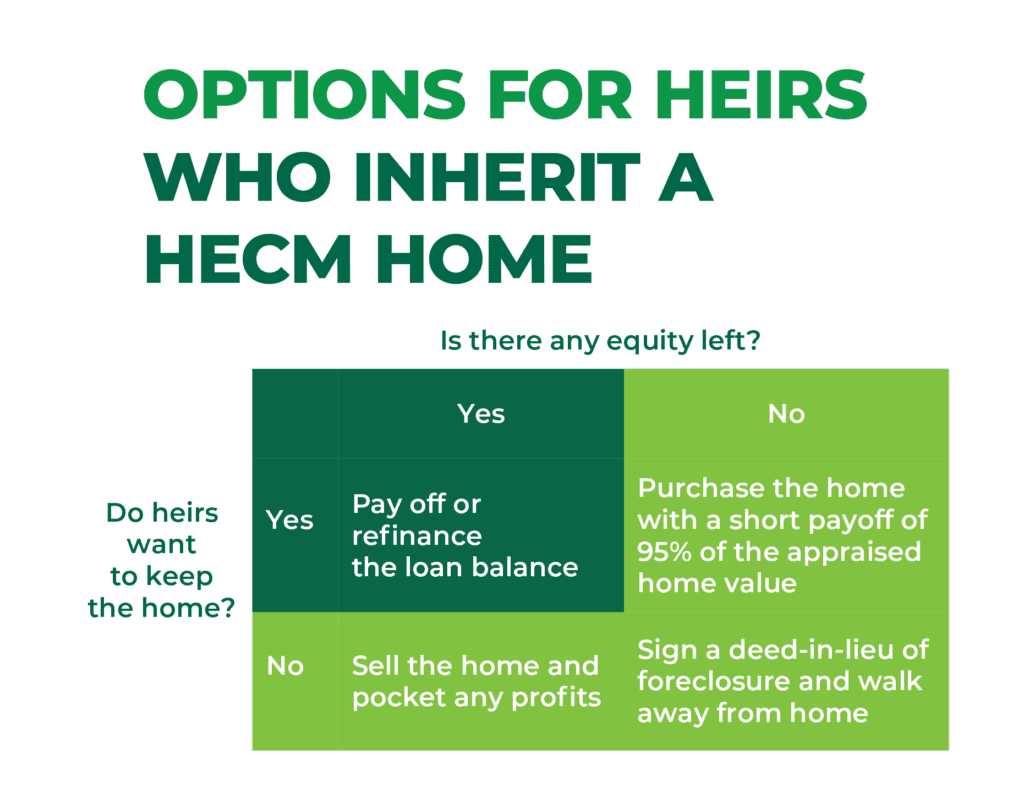

After a borrower passes away, the heirs have six months to decide how to proceed with the property. They can:

- Sell the home and pocket any profit

- Sign a deed-in-lieu of foreclosure and walk away from the home (when they don’t want the home and there is no financial benefit from selling the home, utilizing the non-recourse feature)

- Pay off the mortgage balance and keep the home

- Obtain a short payoff of 95% of the current home value (when they want to keep the home and the loan balance exceeds the home value, utilizing the non-recourse feature)

Heirs can request up to two 90-day extensions for additional time to sell the home as long as they show progress is being made.

The Real Estate Landscape, Inflation and HECMs

As housing values are crucial to maximizing HECM loan proceeds, the current housing market is an excellent reason for many of your 62 and older clients to explore reverse mortgages.

For example, from 2000 to 2020, the median national home price rose by 99%. From 2020 to 2023 alone, home values rose 26%. While home values may continue to increase in the near future, housing values are cooling in various regions and cities around the country, with some experts predicting price gains are near their peak for 2023.

At the same time, inflation rose 3.7% from 2022 to 2023, and markets remain volatile. Prices for essentials and luxuries continue to increase while portfolio values and income from dividends, interest and capital gains are far less reliable. This, combined with the likelihood that home values have peaked (or will soon), means that now may be the best time for a reverse mortgage loan.

Why HECMs Are Essential for Estate Planning

Home equity is great, but it’s illiquid. It cannot be readily used by the homeowner and thus cannot be strategically and proactively applied to protecting or enhancing the estate. As for the economy, inflation continues to erode the quality of life and retirement assets of many retirees.

HECMs offer an alternative source of cash flow that the borrower can use however they see fit, such as to fund attorney fees to do the trusts, wills and advanced directives that are critical in avoiding problems after passing.

However, that’s just the tip of the potential benefit iceberg that reverse mortgage loans can offer to estate planning.

Optimized Asset Management*

Incorporating HECMs into estate planning can significantly improve asset efficiency. Beneficiaries can enhance their legacy through the equity built in their homes, gaining access to funds while retaining property ownership.

Financial Versatility and Growth*

Borrowers can channel HECM funds into diverse needs, from addressing medical bills and home improvements to ensuring a more relaxed lifestyle or directing investments for monetary expansion. This adaptability adds real value to various estate planning strategies.

Protection Through Non-Recourse Loans

When the HECM loan becomes due and payable, if the home sale is less than the loan amount, the mortgage insurance paid by the borrower and other HECM borrowers (MIPs) covers the difference, not the borrower or their heirs.** Again, this means the lender cannot pursue the borrower’s other assets if the loan balance exceeds the home’s value, which can protect other facets of the estate from potential liability.

Strategic Tax-Efficient Wealth Transfer*

HECM-acquired funds are generally tax-exempt, creating an effective method for wealth transfer and conserving the estate’s worth. Leveraging such tax benefits can be pivotal in enhancing estate planning outcomes. Also, some HECM borrowers use the loan proceeds to buy life insurance that would benefit their heirs.

Financial Risk Countermeasures*

HECMs can be a forward-thinking method to counter financial uncertainties in post-retirement life, offering a steady flow of tax-free cash and reducing the risk of depleting other retirement resources in volatile markets and downturns.

Elevated Lifestyle Standards

For numerous retirees on a fixed income, greater cash flow can significantly impact their quality of life. The extra money from a HECM can uplift borrowers’ living standards, alleviating financial worries and providing more latitude to enjoy life.

Purposeful Legacy Design

Intelligently integrating HECMs into estate blueprints can help create a legacy in the here and now. It paves the way for individuals to extend financial support to family or make impactful charitable donations in their lifetime.

Final Thoughts: Crafting a Focused Estate Blueprint With HECMs

While HECMs may not apply to all estate planning clients, many could benefit significantly by incorporating a HECM into their strategy. By allowing homeowners to access their property’s equity and appreciation without giving up the title, HECMs can be a powerful tool to help clients achieve fiscal assurance while creating an estate of which they can be proud.

*This advertisement does not constitute tax and/or financial advice from Fairway.

**There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

Copyright©2023 Fairway Independent Mortgage Corporation. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. Distribution to general public is prohibited. All rights reserved. Equal Housing Opportunity.