Reverse Mortgage Loans: Information for Adult Children

Whether it’s surging living costs, healthcare expenses or insurance premiums, adult children are anxious about their parents’ economic stability, with nearly one-third expressing concern for their parents’ financial situation. Adult children may also be concerned about being able to support their parents financially while raising a family of their own.

Cash flow is king in retirement. When it comes to retirement cash flow planning, tapping home equity is often overlooked or dismissed, but it should be part of the conversation. By diversifying home equity, senior homeowners may be better equipped to manage risks, like spending surprises and inflation, throughout retirement.

When adult children discuss a reverse mortgage loan with their parents, they often have questions about inheritance and home equity, loan repayment, financial implications and more.

We want to ensure every family member is informed. With that in mind, here are answers to some common questions that adult children have when their parents are considering (or have) a reverse mortgage loan.

What This Article Covers:

- What Is a Reverse Mortgage?

- How Does a Reverse Mortgage Work?

- Will My Parents Still Own Their Home?

- Could I Be Stuck With a Big Bill?

- What Happens When They Pass Away?

- Will There Be Any Home Equity Left To Inherit?

- How Can Loan Proceeds Be Used?

- What Are the Downsides To Reverse Mortgages?

- How Is the HECM Line of Credit Different Than a HELOC?

What Is a Reverse Mortgage?

A reverse mortgage is a home-secured loan for older adults where repayment of the loan balance can be deferred until a much later date — generally until the last remaining borrower either passes away or moves out. While there are no required monthly principal or interest mortgage payments, the borrower must pay critical property charges, like taxes and insurance.

The most popular reverse mortgage in the U.S. is the Federal Housing Administration (FHA)-insured Home Equity Conversion Mortgage (HECM) loan. A HECM allows homeowners and homebuyers 62 and over to convert a portion of their home equity into a lump sum of cash, fixed monthly payouts, a line of credit or a combination of these options.

For simplicity, this article will refer only to the HECM reverse mortgage option. Fairway is ready to assist if you require specific information on any other type of reverse mortgage loan.

How Does a Reverse Mortgage Work?

With a traditional mortgage, the flow of funds generally moves from the borrower’s bank account to the lender. Naturally, the loan balance decreases over time as the borrower makes payments.

With a HECM, the flow of funds is typically reversed. The lender or servicer is the one making the payments to the borrower. A good way to think of it is that the lender is giving your parents an advance on their home equity.

Of course, a HECM isn’t free money. Like a traditional mortgage, with a HECM, the borrower must repay the borrowed amount, plus interest and fees. However, a HECM offers the borrower much greater repayment flexibility than a traditional mortgage, enabling the potential for significantly increasing cash flow in retirement.

So, if your parents want to make a payment toward the loan balance, they can do so at any time. If your parents want to defer repayment of the loan balance until they move out or pass away, they have that option, too. Remember, the borrower must pay the critical property charges, like taxes and insurance, for the loan to remain in good standing.

Will My Parents Still Own Their Home?

Many people believe the lender takes the borrower off title when a reverse mortgage loan is established — that the borrower will no longer own the home. In actuality, your parents and the heirs retain control of the title. Your parents can sell the home anytime and leave it to you as an inheritance.

Could I Be Stuck With a Big Bill?

Passing a debt obligation is a big concern for the borrower and their heirs. It’s important to understand that neither you nor your parents will ever owe more than the home’s value when the loan is due and payable, and the home is sold.* That’s because all reverse mortgages are non-recourse loans.

Non-recourse means the home stands for the debt, not the borrower or the heirs. With a HECM, this feature is insured by the FHA, so you can rest easy knowing you’ll never be responsible for reverse mortgage debt that may accrue beyond the home value.

What Happens When They Pass Away?

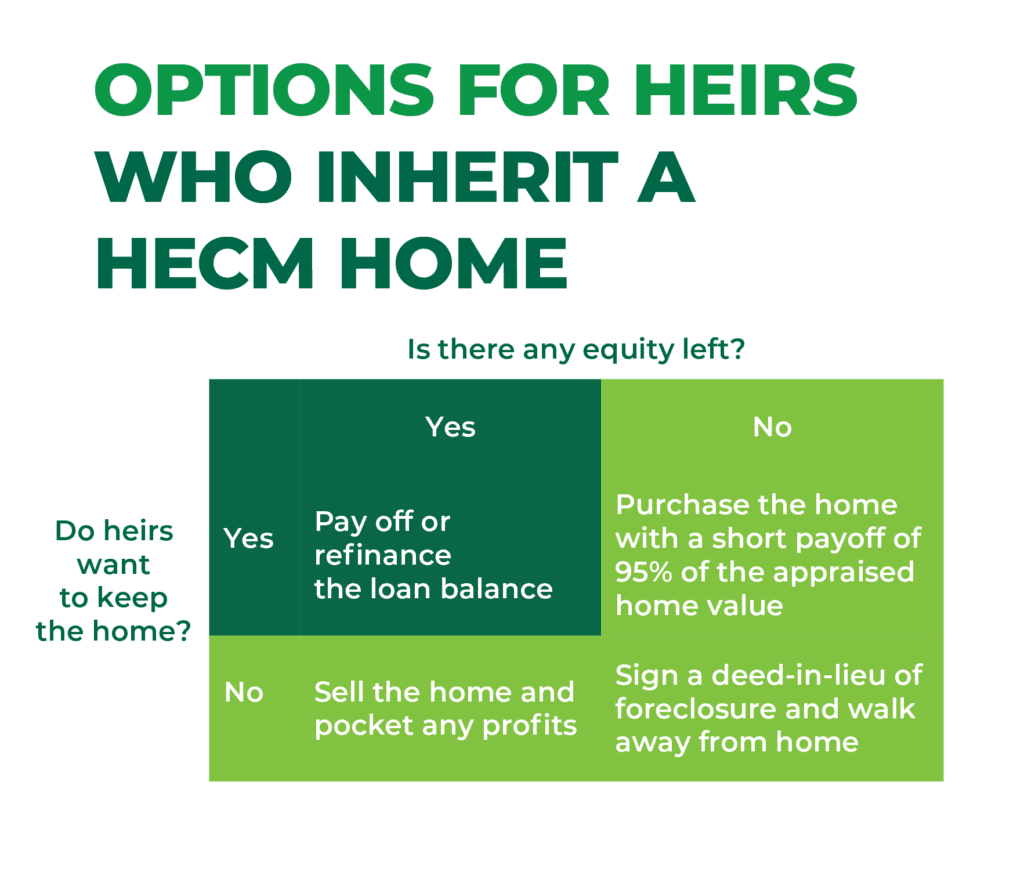

In the event of your last surviving parent passing away, the loan would become due and payable. Heirs have several options based on whether they want to keep the home.

When You DON’T WANT To Keep the Home:

- Sell the home and pocket any profit

- Sign a deed-in-lieu of foreclosure and walk away from the home (when there is no financial benefit from selling the home)

When You WANT To Keep the Home:

- Pay off the mortgage balance and keep the home

- Obtain a short payoff of 95% of the current home value (when the loan balance exceeds the home value)

You can download and save this handy guide: How to Satisfy the HECM Loan When It Becomes Due and Payable.

Will There Be Any Home Equity Left To Inherit?

This question is impossible to answer without knowing how much reverse mortgage funds your parents will access over the life of the loan, how long they will have the loan, how much of the loan they will voluntarily pay back or defer repayment on and what interest rates and home values will do in the future.

While you may receive less inheritance (or no inheritance) in the form of home equity, a reverse mortgage can help your parents establish a more efficient retirement cash flow strategy. This can help them preserve other productive retirement assets, like 401(k) and savings accounts, which could mean greater net assets to pass along.**

How Can Loan Proceeds Be Used?

From closing a gap in retirement cash flow to enhancing a retirement lifestyle or a sound retirement strategy, a reverse mortgage opens the door to many possibilities. Your parents can use their reverse mortgage loan proceeds however they wish. Here are some common ways HECM borrowers choose to use their HECM loan proceeds:

- Eliminate their monthly mortgage payment (must pay property charges, like taxes and insurance)

- Pay for aging-in-place home renovations

- Gift an inheritance with a warm hand

- Pay off high-interest credit cards

- Pay for long-term care insurance or in-home care

- Establish a rainy-day fund

What Are the Downsides to Reverse Mortgages?

Understanding the pros and cons of a reverse mortgage is crucial in making an informed decision. Here are some of the downsides to a reverse mortgage loan.

- The unpaid reverse mortgage loan balance grows over time, chipping away at home equity. This is because interest and fees get added to the unpaid loan balance

- Potentially reduced inheritance in the form of home equity

- Eligibility to qualify for needs-based programs, such as Medicaid, may be affected

- The total loan costs tend to be higher for a reverse mortgage compared to other types of mortgages

- Failure to meet property charge obligations, like taxes and insurance, could lead to foreclosure

How Is the HECM Line of Credit Different Than a HELOC?

While a traditional Home Equity Line of Credit (HELOC) may have lower overall costs, a HECM line of credit offers some distinct advantages that can be very appealing to older homeowners. Here’s a features comparison chart of the two products:

| Home Equity Line of Credit (HELOC) | HECM Line of Credit | ||

| As an adult, is there a minimum age I need to be? | No | 62+ | |

| Do the unused funds in the line of credit accrue interest? | No | No | |

| Are there required monthly principal and/or interest mortgage payments? | Yes | No1 | |

| Does the unused portion of the line of credit grow over time to produce greater borrowing capacity? | No | Yes (grows at the same rate as the loan balance) | |

| Is it a non-recourse loan? (Never owe more than the home is worth when it’s sold)2 | No | Yes | |

| Are the draw periods limited? | Yes. Typically, there’s a 5- or 10-year draw period (timeframe depends on product) | No | |

| Are there any prepayment penalties? | Depends on product | No | |

| Which product is generally easier for 62+ homeowners to qualify for? | More difficult | Easier | |

| Can the line of credit be frozen, reduced or canceled based on market conditions? | Yes | No |

1Must pay the property charges, like taxes and insurance.

2There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

Let’s Start a Conversation!

Are you or someone you care about considering a reverse mortgage loan? It's essential for families to have open and honest conversations, involve reverse mortgage professionals and, if necessary, consult with legal and financial advisors to address any concerns and questions. At Fairway, we’re here to help. Connect with us today.

*There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

**This advertisement does not constitute tax or financial advice. Please consult your tax and/or financial advisor for your specific situation.